In business, companies often reach a point where they must grow financially to succeed. One strategic move that can pave the way for such growth is the judicious addition of share capital. In this guide, we’ll show you the simple steps to follow to add capital in your company, making sure you do everything right according to the rules set by the Office of Company Registration (OCR) in Nepal.

Step 1: Prepare Minutes for Capital Addition (पुजी बृद्धि)

The first stride in this journey is to convene a meeting where the decision to augment the capital structure is discussed and documented. These minutes serve as a legal record of the decision-making process, highlighting key aspects such as the quantum of capital to be added and the rationale behind it. Be thorough in detailing the deliberations, ensuring clarity for future reference.

The minutes should include the decision to change the clauses in Prabandhapatra to reflect the addition of share capital.

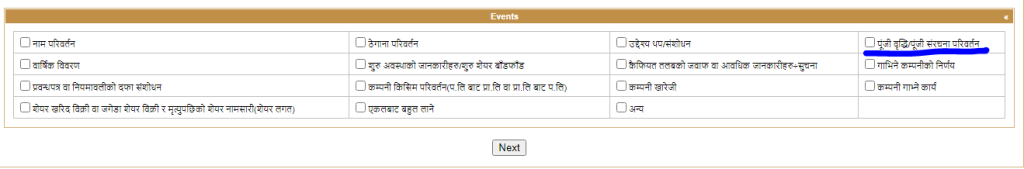

Step 2: Submission to OCR

With the minutes in hand, the next imperative is to submit them to the OCR. This involves a meticulous process, and precision is paramount. Ensure that all required information is accurately presented, as any oversight could lead to unnecessary delays. The OCR officials check the minutes and transactions, and compliance.

Step 3: Compilation of Supporting Documents

Accompanying the minutes, a robust set of supporting documents is required to substantiate the decision. This includes, but is not limited to, bank statements reflecting the financial capacity to support the proposed capital addition and vouchers that validate the authenticity of the transactions. Thoroughness in document preparation is the key to a smooth verification process.

Addition of Authorized and Issued capital does not require any additional supporting documents but addition of paid up capital require bank statement where the shareholder ave deposited the increased sum in the company’s account

Step 4: Verification by OCR

Once submitted, the OCR meticulously reviews the documents to ensure compliance with regulatory standards. This stage involves a detailed scrutiny of the submitted materials, and any discrepancies could lead to a request for clarification or additional documentation. Timely responses to OCR queries are crucial to maintaining the momentum of the process.

Conclusion

In conclusion, the process of adding Authorized, Issued, and Paid-up Capital is a strategic move that can propel a company towards unprecedented growth. The steps outlined here provide a roadmap for companies registered in Nepal to navigate this process with precision and compliance. It’s crucial to approach each step meticulously, ensuring that all documentation is accurate and comprehensive.